As highlighted in this press release – and this related case study – Cooley was issuer’s counsel in the MapLight Therapeutics IPO that priced earlier this week. It’s a rarity for an IPO to price during a government shutdown (and Cooley helped Navan price an IPO yesterday, so two historic IPOs in a single week). So much so that SEC Chairman Paul Atkins tweeted about the deal:

It is wild that there was a company that went effective automatically and priced during a shutdown. Without a delaying amendment – as permitted by the SEC’s shutdown guidance and guidance from the stock exchanges – the company’s registration statement went effective automatically twenty days after filing under Section 8(a) of the Securities Act of 1933.

The last time something like this happened probably was during the 1930s, back in an era where the SEC Commissioners themselves would review registration statements – as there were very few SEC Staff members – and there were no delaying amendments.

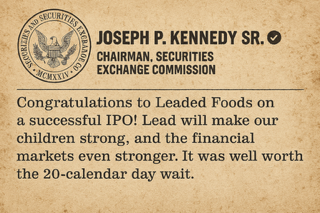

Alan Hambelton was kind enough to share this fictitious tweet from Joe Kennedy, who served as the first SEC Chairman when the SEC was founded in 1934:

Authored by

Broc Romanek